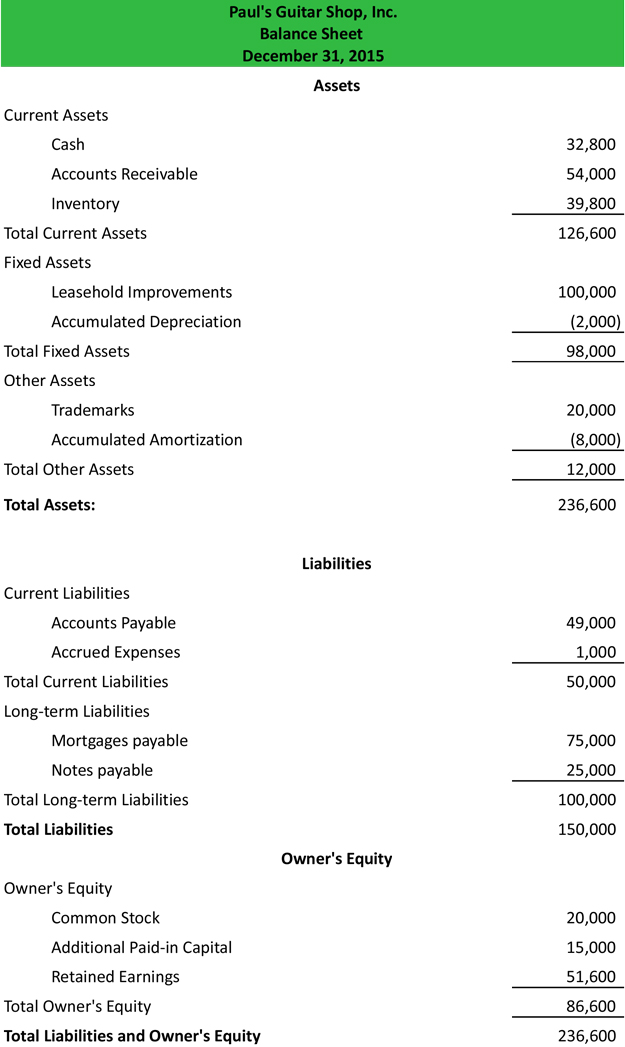

Balance Sheet Example With Depreciation . using the last example, following double entries will be recorded in respect of depreciation: This means you’ll see more overall depreciation on your balance sheet than you. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. It also calculates the amount of depreciation expense. your balance sheet will record depreciation for all of your fixed assets. estimated residual value. The cost for each year you. balance sheet depreciation calculates the decrease in the value of an asset over its useful life. our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet. The purchase price of an asset is its cost plus all other. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the.

from hirewriting26.pythonanywhere.com

It also calculates the amount of depreciation expense. The purchase price of an asset is its cost plus all other. This means you’ll see more overall depreciation on your balance sheet than you. using the last example, following double entries will be recorded in respect of depreciation: your balance sheet will record depreciation for all of your fixed assets. balance sheet depreciation calculates the decrease in the value of an asset over its useful life. estimated residual value. our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The cost for each year you.

Neat A Classified Balance Sheet Is Partnership Firm Format In Excel

Balance Sheet Example With Depreciation This means you’ll see more overall depreciation on your balance sheet than you. your balance sheet will record depreciation for all of your fixed assets. our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet. The cost for each year you. It also calculates the amount of depreciation expense. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the. using the last example, following double entries will be recorded in respect of depreciation: The purchase price of an asset is its cost plus all other. This means you’ll see more overall depreciation on your balance sheet than you. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. balance sheet depreciation calculates the decrease in the value of an asset over its useful life. estimated residual value.

From livewell.com

Where Does Depreciation Expense Go On A Balance Sheet LiveWell Balance Sheet Example With Depreciation accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. balance sheet depreciation calculates the decrease in the value of an asset over its useful life. using the last example, following double entries will be recorded in respect of depreciation: The cost for each year you.. Balance Sheet Example With Depreciation.

From old.sermitsiaq.ag

Excel Depreciation Template Balance Sheet Example With Depreciation accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the. This means you’ll see more overall depreciation on your balance sheet than you. The purchase. Balance Sheet Example With Depreciation.

From sailsojourn.com

8 ways to calculate depreciation in Excel (2023) Balance Sheet Example With Depreciation our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet. It also calculates the amount of depreciation expense. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the. balance sheet depreciation calculates the decrease in the value of an. Balance Sheet Example With Depreciation.

From www.geeksforgeeks.org

Provision for Depreciation and Asset Disposal Account Balance Sheet Example With Depreciation your balance sheet will record depreciation for all of your fixed assets. The purchase price of an asset is its cost plus all other. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the. The cost for each year you. It also calculates the amount of. Balance Sheet Example With Depreciation.

From ar.inspiredpencil.com

Balance Sheet Example With Depreciation Balance Sheet Example With Depreciation accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. balance sheet depreciation calculates the decrease in the value of an asset over its useful life. The purchase price of an asset is its cost plus all other. your balance sheet will record depreciation for all. Balance Sheet Example With Depreciation.

From www.carboncollective.co

Classified Balance Sheet Template, Purpose, Classifications, Example Balance Sheet Example With Depreciation The purchase price of an asset is its cost plus all other. balance sheet depreciation calculates the decrease in the value of an asset over its useful life. your balance sheet will record depreciation for all of your fixed assets. The cost for each year you. using the last example, following double entries will be recorded in. Balance Sheet Example With Depreciation.

From visualcow11.gitlab.io

Wonderful Balance Sheet Accounts Are Not Affected By Adjustments Profit Balance Sheet Example With Depreciation The purchase price of an asset is its cost plus all other. The cost for each year you. using the last example, following double entries will be recorded in respect of depreciation: balance sheet depreciation calculates the decrease in the value of an asset over its useful life. accumulated depreciation is the total decrease in the value. Balance Sheet Example With Depreciation.

From www.kpgtaxation.com.au

How to Find Depreciation in Balance Sheet Balance Sheet Example With Depreciation your balance sheet will record depreciation for all of your fixed assets. The purchase price of an asset is its cost plus all other. It also calculates the amount of depreciation expense. estimated residual value. This means you’ll see more overall depreciation on your balance sheet than you. using the last example, following double entries will be. Balance Sheet Example With Depreciation.

From www.numerade.com

SOLVED CRUZ, INCORPORATED Comparative Balance Sheets 2021 At December Balance Sheet Example With Depreciation estimated residual value. This means you’ll see more overall depreciation on your balance sheet than you. balance sheet depreciation calculates the decrease in the value of an asset over its useful life. It also calculates the amount of depreciation expense. using the last example, following double entries will be recorded in respect of depreciation: The cost for. Balance Sheet Example With Depreciation.

From mavink.com

Depreciation Table Examples Balance Sheet Example With Depreciation balance sheet depreciation calculates the decrease in the value of an asset over its useful life. The cost for each year you. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the. It also calculates the amount of depreciation expense. This means you’ll see more overall. Balance Sheet Example With Depreciation.

From dxozldkxu.blob.core.windows.net

Fax Machine Depreciation Rate at William Lopez blog Balance Sheet Example With Depreciation using the last example, following double entries will be recorded in respect of depreciation: It also calculates the amount of depreciation expense. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The purchase price of an asset is its cost plus all other. balance sheet. Balance Sheet Example With Depreciation.

From slidesdocs.com

Balance Method Depreciation Form Excel Template And Google Sheets File Balance Sheet Example With Depreciation balance sheet depreciation calculates the decrease in the value of an asset over its useful life. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The purchase price of an asset is its cost plus all other. using the last example, following double entries will. Balance Sheet Example With Depreciation.

From haipernews.com

How To Calculate Depreciation Balance Sheet Haiper Balance Sheet Example With Depreciation balance sheet depreciation calculates the decrease in the value of an asset over its useful life. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. It also calculates the amount of depreciation expense. using the last example, following double entries will be recorded in respect. Balance Sheet Example With Depreciation.

From www.scribd.com

Balance Sheet Expense Depreciation Balance Sheet Example With Depreciation your balance sheet will record depreciation for all of your fixed assets. The cost for each year you. estimated residual value. The purchase price of an asset is its cost plus all other. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. This means you’ll. Balance Sheet Example With Depreciation.

From www.vertex42.com

Depreciation Schedule Template for StraightLine and Declining Balance Balance Sheet Example With Depreciation balance sheet depreciation calculates the decrease in the value of an asset over its useful life. This means you’ll see more overall depreciation on your balance sheet than you. using the last example, following double entries will be recorded in respect of depreciation: The cost for each year you. contents [show] the balance sheet, also called the. Balance Sheet Example With Depreciation.

From www.accountingcoach.com

Sample Balance Sheet AccountingCoach Balance Sheet Example With Depreciation The cost for each year you. accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The purchase price of an asset is its cost plus all other. estimated residual value. This means you’ll see more overall depreciation on your balance sheet than you. balance sheet. Balance Sheet Example With Depreciation.

From ar.inspiredpencil.com

Balance Sheet Example With Depreciation Balance Sheet Example With Depreciation This means you’ll see more overall depreciation on your balance sheet than you. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the. your balance sheet will record depreciation for all of your fixed assets. our explanation of depreciation emphasizes what the depreciation amounts on. Balance Sheet Example With Depreciation.

From www.reddit.com

[HOMEWORK] Partial balance sheet, not sure what to credit after Balance Sheet Example With Depreciation estimated residual value. The cost for each year you. using the last example, following double entries will be recorded in respect of depreciation: The purchase price of an asset is its cost plus all other. contents [show] the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the.. Balance Sheet Example With Depreciation.